Tax Benefits Of Running A Business From Home

The home office is one of the best known tax advantages for a home based business and for good reason. Getty images if you have a dedicated space in your home that you use for business you can claim it and some of your home expenses on your tax return as long as you meet the irs requirements for a home office deduction.

The Tax Advantages Of Owning A Home Based Business Youtube

The Tax Advantages Of Owning A Home Based Business Youtube

tax benefits of running a business from home

tax benefits of running a business from home is important information with HD images sourced from all the best websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in tax benefits of running a business from home content depends on the source site. We hope you do not use it for commercial purposes.

Your business will be able to claim tax relief on domestic bills for the areas of the house used for your business.

Tax benefits of running a business from home. When selling your home you may be liable for capital gains tax on any capital gain. Running your business from home if. If your business is vat registered you may be able to claim.

Running a home based business can offer tax deductions on home repairs in addition to typical business expenses. The canada revenue agency recognizes the costs involved with running a business from your home and offers a deduction for qualifying business use of home. Your home based business is in a unique tax situation.

There are a number of tax advantages to having your home and office under one roof. This includes expenses incurred operating your business from a home office. And once your business is up and running its cheaper and easier to maintain than a separate business location.

If your situation qualifies you can deduct a portion of your homes expenses such as mortgage interest property taxes utilities. Running a business from home offers a range of conveniences and advantages but it also means you may lose living space and have to pay for extra electricity and utilities for your business. If your home is your primary place of business you may be able to claim deductions for expenses you incur.

As a home business owner youre able to take a variety of tax deductions related to the cost of running your business. There was a time that it. You can deduct a percentage of most household bills mortgage or rent utilities property taxes insurance phone and.

Your home business can take all the usual business tax deductions but some work differently and some are unique to home businesses. Two kinds of home. The tax benefits of operating a home office can be lucrative.

Running a business from home insurance business rates expenses tax allowances skip to main content tell us whether you accept cookies we use cookies to collect information about how you use. Working from home can help you save money on tax.

Tax Benefits Of Running Your Home Business

Tax Benefits Of Running Your Home Business

Tax Benefits Of Starting A Home Based Business See How We Can Help

Tax Benefits Of Starting A Home Based Business See How We Can Help

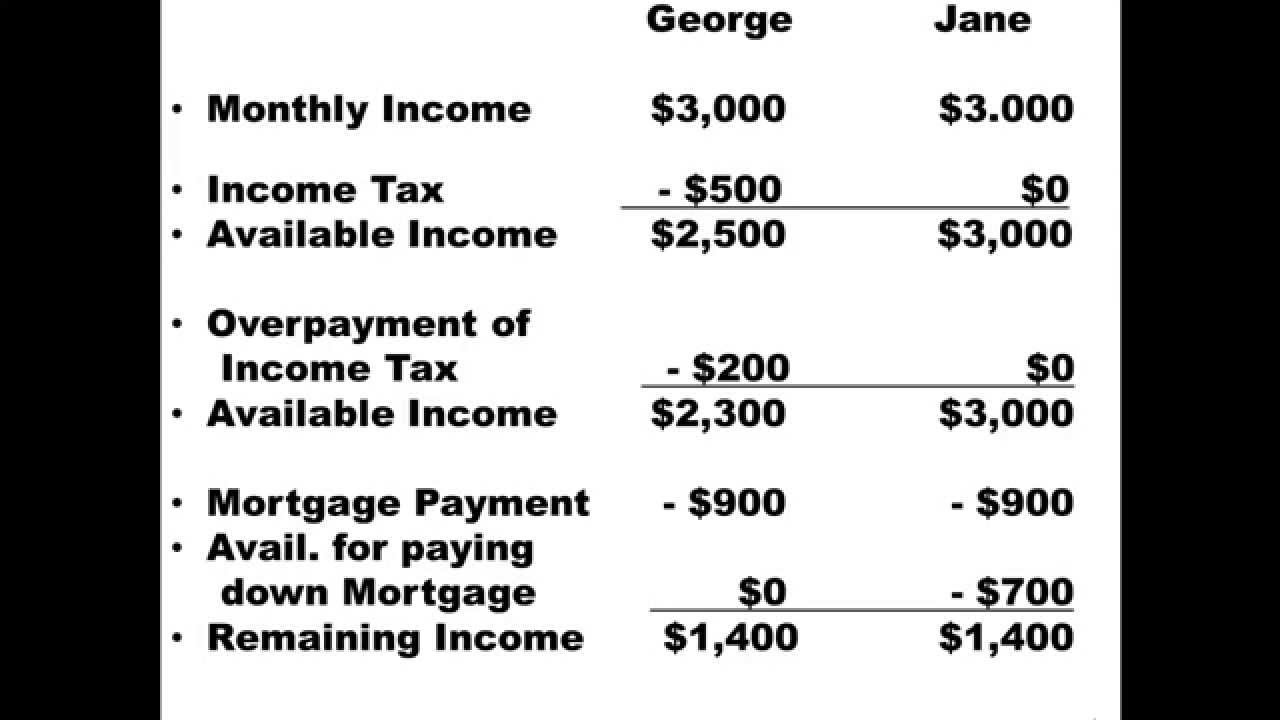

Chapter Six Entrepreneurship And Starting A Small Business Mcgraw

Chapter Six Entrepreneurship And Starting A Small Business Mcgraw

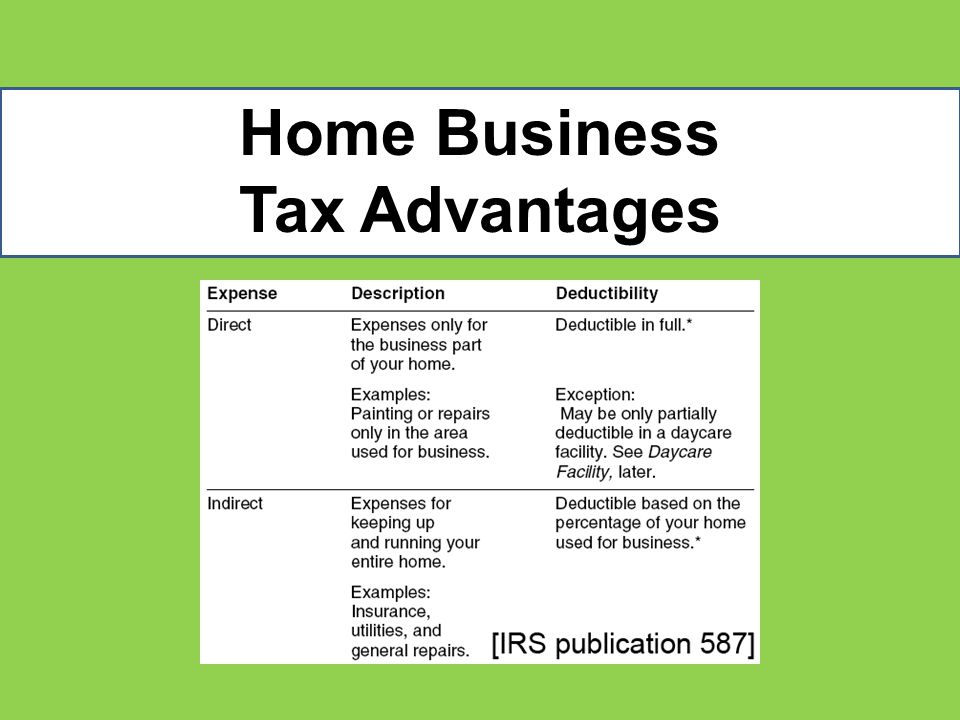

Home Business Tax Advantages Qualifications Intent To Make A

Home Business Tax Advantages Qualifications Intent To Make A

Tax Benefits Of Starting A Home Based Business Home Based

Tax Benefits Of Starting A Home Based Business Home Based

A Guide To Tax Deductions For Home Based Business

A Guide To Tax Deductions For Home Based Business

Simple Solutions To Starting A Home Business Enterprise

Simple Solutions To Starting A Home Business Enterprise

Tax Benefits Of Starting A Home Based Business

Tax Benefits Of Starting A Home Based Business

Home Business Tax Advantages Qualifications Intent To Make A

Home Business Tax Advantages Qualifications Intent To Make A

Tax Deductible Expenses Home Based Business Quick Money Making

Tax Deductible Expenses Home Based Business Quick Money Making