How Long To Retain Records For A Business

According to the irs heres how long you should keep those records. Keep records indefinitely if you file a fraudulent return.

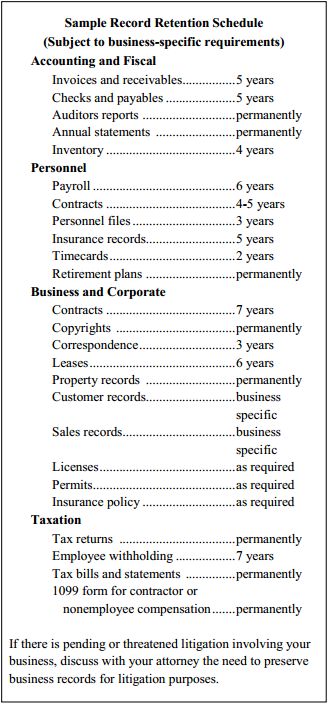

Record Retention Policy How Long To Keep Business Tax Record

Record Retention Policy How Long To Keep Business Tax Record

how long to retain records for a business

how long to retain records for a business is important information with HD images sourced from all the best websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how long to retain records for a business content depends on the source site. We hope you do not use it for commercial purposes.

General ledgers and journals payroll records including.

How long to retain records for a business. If you own a small business you need to keep business records whether in digital or hard copies. If you ever want to sell your business or track what you have done in the past you will need to have. Keep records for 6 years if you do not report income that you should report and it is more than 25 of the gross income shown on your return.

The length of time you should keep a document depends on the action expense or event the document records. The irs recommends saving financial records for up to seven years although some documents should be saved longer than others. Youre closing your business.

In our digital era both paper and here. Yet lawyers accountants banks and government agencies all seem to have different ideas about how long to retain business records depending upon your individual business circumstances. They show a transaction that covers more than one of the.

According to hipaa guidelines covered entities are required to retain medical records for six years from the date of its creation or its last use whichever comes later. Keep records indefinitely if you do not file a return. However if an employee suffers a work related accident or files a claim against the business its advisable to retain your records for up to 10 years after the claim is resolved.

Most business owners dont know how long they should hold on to old records. However the business you are in affects the type of records you need to keep for federal tax purposes. Job applicant information must be kept for at least three years even if you didnt hire the applicant.

Perhaps you are retiring or entering the opportunity for a different venture. Even if you choose not to incorporate your small business it simply makes sense to keep business records. How long should i keep records.

All businesses generate paperwork and once your business is closed the question of how long to keep those documents must. Typically state laws will govern the exact period of time providers must keep medical records however if a states retention laws are shorter than hipaas required six hipaa retention requirements preempt state laws. If you are running a small business you will need to keep records in order to maintain your corporate status.

How long to keep records you must keep records for 6 years from the end of the last company financial year they relate to or longer if.

How Long Should I Keep My Financial Records Big E Z

How Long Should I Keep My Financial Records Big E Z

Here S How Long To Keep All Your Important Financial Documents

How Long Should Businesses Retain Important Records

How Long Should Businesses Retain Important Records

How Long Should You Keep Business Records Federal Records

What Business Records You Should Keep For Tax Purposes Small

What Business Records You Should Keep For Tax Purposes Small

Record Retention 3 Simple Rules Ct Corporation

Record Retention 3 Simple Rules Ct Corporation

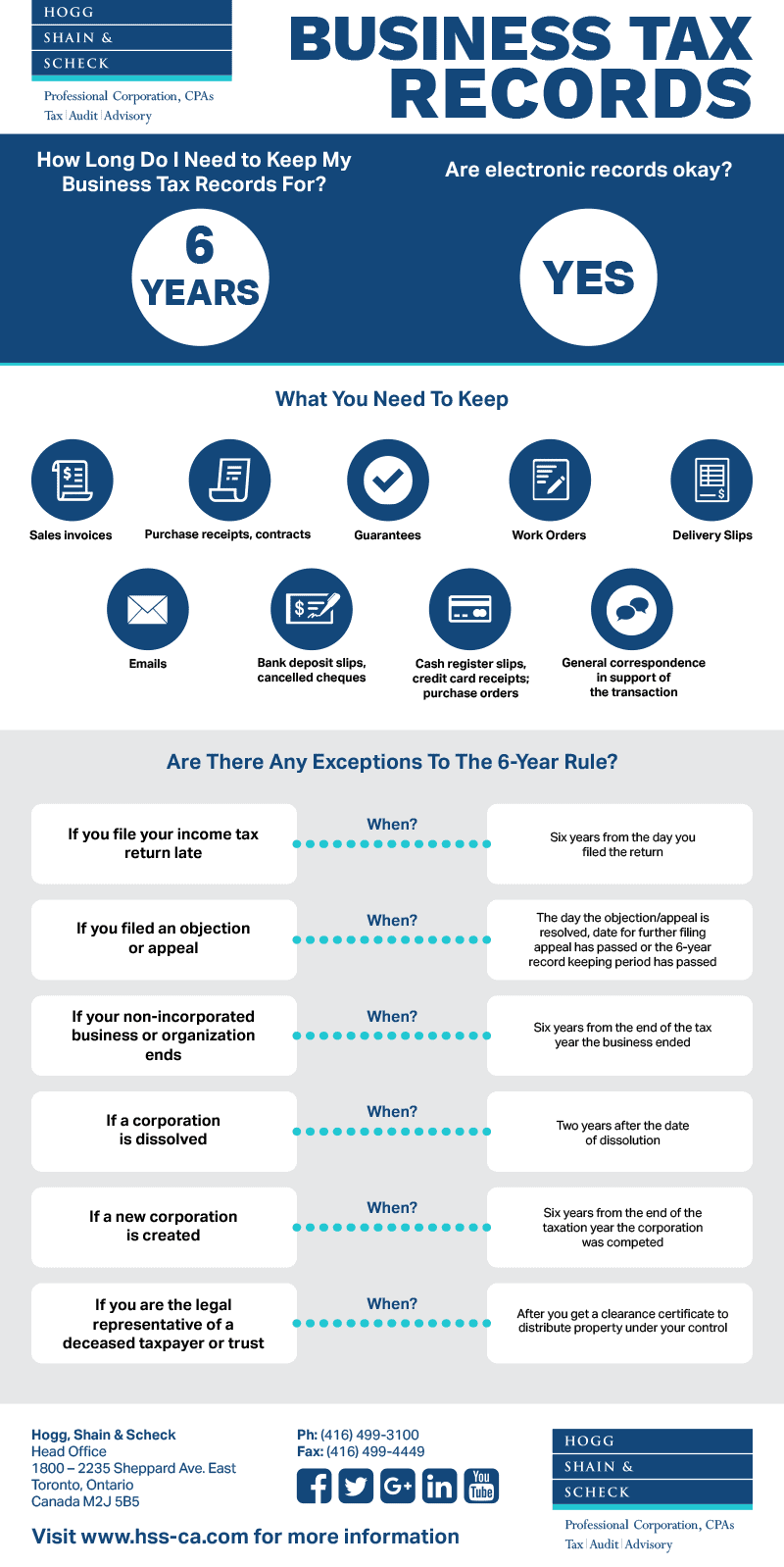

How Long Do I Have To Keep My Business Tax Records Hogg Shain

How Long Do I Have To Keep My Business Tax Records Hogg Shain

Keeping Records For Business What You Need To Know Gervis

In The Studio Smart And Thorough Record Keeping Ceramic Arts

In The Studio Smart And Thorough Record Keeping Ceramic Arts