Is Rental Real Estate A Trade Or Business For 199a

For rental real estate. Taxation florida state bar certified specialist in wills trusts estates aep distinguished and kelsey weiss introduction the 2017 tax cuts and jobs act introduced the new and sometimes problematic section 199a to the internal revenue code.

Qbi Deduction Section 199a Trade Or Business Safe Harbor Rental

Qbi Deduction Section 199a Trade Or Business Safe Harbor Rental

is rental real estate a trade or business for 199a

is rental real estate a trade or business for 199a is important information with HD images sourced from all the best websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in is rental real estate a trade or business for 199a content depends on the source site. We hope you do not use it for commercial purposes.

Samples february 21 2019 on january 18 2019 final regulations were issued relating to irc section 199a the 20 pass through.

Is rental real estate a trade or business for 199a. 199a if at least 250 hours of services are performed each tax year with respect to the enterprise. Rental real estate and qualified business income deduction irc section 199a teri m. 199a 4 d examples 16 17 and 18.

Real estate activities are not considered a trade or business if real property is used as a residence as defined in sec. 280a ie it is used personally by an owner for a number of days that exceeds the greater of 14 days or 10 of. Related firm news publications.

Which means the 64 question is when does real estate rental activity become a trade or business. Rental as section 199a trade or business a rental real estate enterprise will be treated as a trade or business for a taxable year solely for purposes of section 199a if the following requirements are satisfied during the taxable. 199a 4 d examples 8 and 9.

Does a rental real estate business qualify. Section 199a was designed to provide taxpayers with a 20 deduction for qualified business income earned through. The final regulations also provide examples clarifying when a rental real estate trade or business can be grouped with nonrental trades or businesses see regs.

You get to take the section 199a deduction only when your real estate activity rises to the level of a trade or business. The active rental of real estate being a dealer or. By way of brief review the section 199a deduction allows up to a 20 deduction from net income received from a qualified trade or business.

If your rental activity does not qualify as a section 162 trade or business it will qualify for the 20 percent section 199a tax deduction if you rent it to a commonly controlled trade or business. Under the safe harbor a rental real estate enterprise is treated as a trade or business for purposes of sec. Examples of when multiple rental real estate trades or businesses can or cannot be grouped together are also provided see regs.

One of the most substantial changes to the tax code included with the tax cuts and jobs act tcja is the ability potentially to deduct 20 of qualified business income qbi.

Qbi Deduction Section 199a Trade Or Business Safe Harbor Rental

Qbi Deduction Section 199a Trade Or Business Safe Harbor Rental

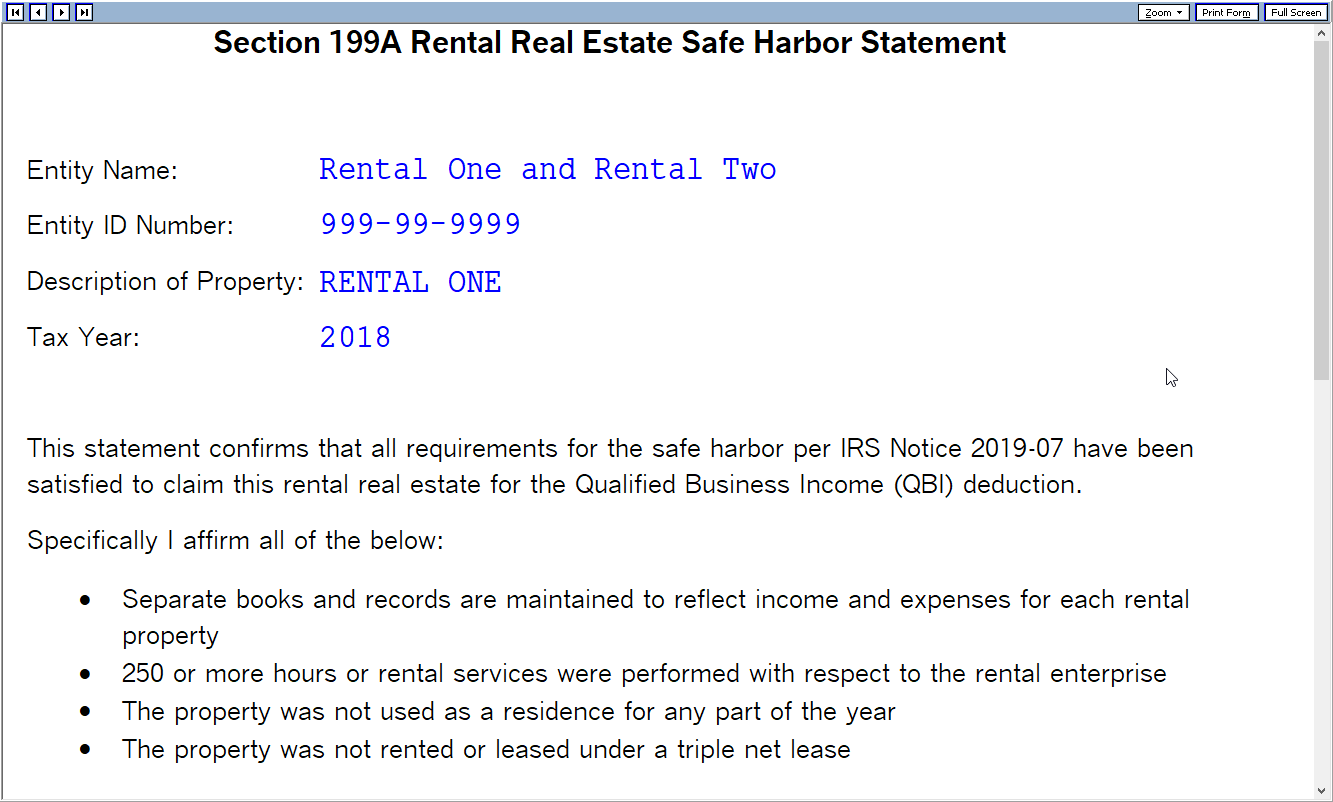

Notice 2019 07 199a Safe Harbors For Rental Real Estate

Notice 2019 07 199a Safe Harbors For Rental Real Estate

Qbi Deduction Section 199a Trade Or Business Safe Harbor Rental

Qbi Deduction Section 199a Trade Or Business Safe Harbor Rental

When Is Rental Real Estate A Trade Or Business Dallas Business

When Is Rental Real Estate A Trade Or Business Dallas Business

Irs Section 199a Trade Or Business Rental Real Estate Hkg Llp

Irs Section 199a Trade Or Business Rental Real Estate Hkg Llp

Section 199a Rental Property Trade Or Business Definition

Section 199a Rental Property Trade Or Business Definition

Krozel Capital New Deduction For Rental Property Owners Krozel

Krozel Capital New Deduction For Rental Property Owners Krozel

Documenting The Sec 199a Rental Real Estate Safe Harbor Houston

Documenting The Sec 199a Rental Real Estate Safe Harbor Houston

199a Deduction For Rental Real Estate Investors Mark J Kohler

199a Deduction For Rental Real Estate Investors Mark J Kohler

Is Your Rental Property A Qualified Trade Or Business Lswg Cpas

Is Your Rental Property A Qualified Trade Or Business Lswg Cpas