What Is The Business Tax Rate In California

The california corporate tax rate has not yet provided small business owners with incentives for doing business in the state. In california only groceries some prescription drugs and some alternative energy equipment are exempt from sales tax.

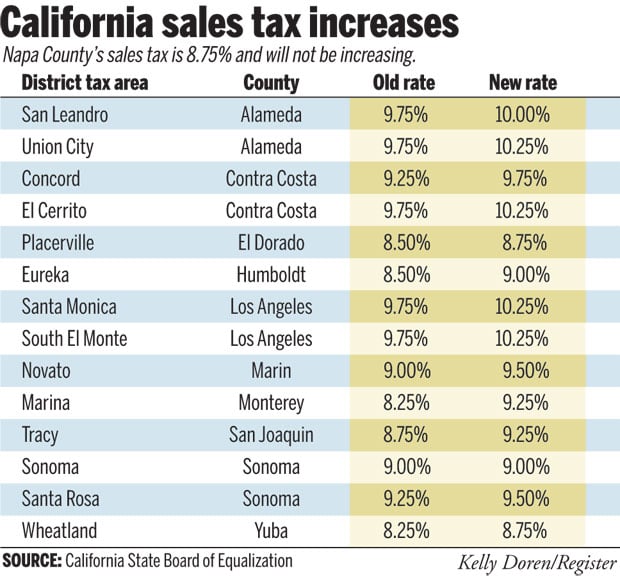

New California City Sales Tax Rates Take Effect On April 1

New California City Sales Tax Rates Take Effect On April 1

what is the business tax rate in california

what is the business tax rate in california is important information with HD images sourced from all the best websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in what is the business tax rate in california content depends on the source site. We hope you do not use it for commercial purposes.

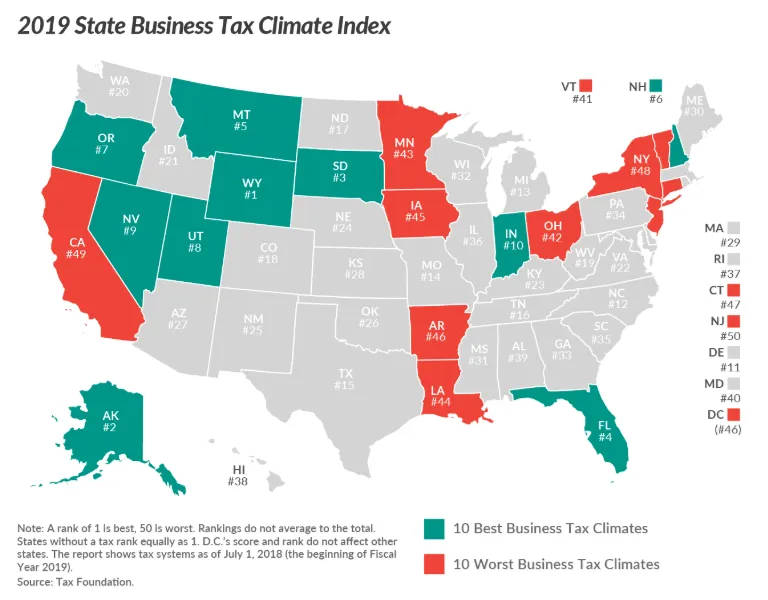

The corporate tax rate applies to your businesss taxable income which is your revenue minus expenses.

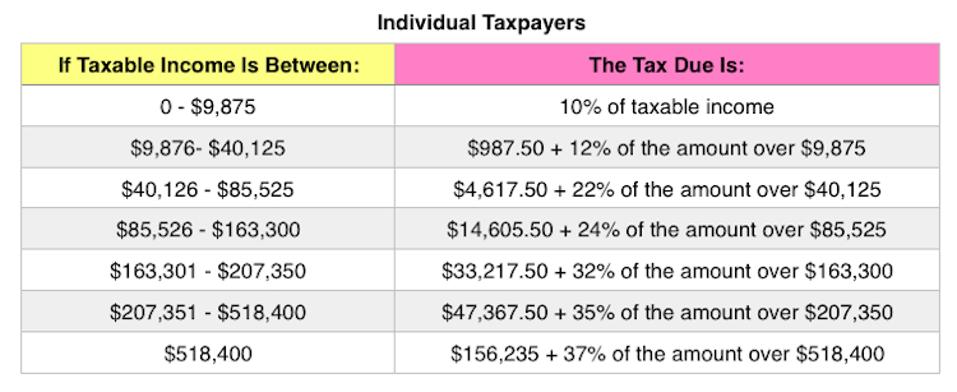

What is the business tax rate in california. Example lets say you have annual revenues of 250000 and expenses of 55000you want to figure out how much you owe in federal taxes. California corporate tax rate however california is known as the home to several diverse vibrant and growing metropolitan cities including los angeles oakland and sacramento. Personal income tax booklet 2019 california tax rate schedules.

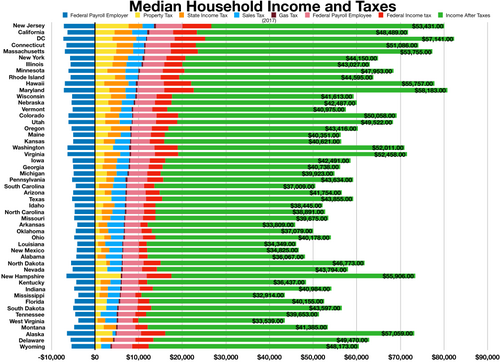

The california franchise tax board explains that the tax is charged for the privilege of conducting business in california each llc is charged a minimum llc tax of 800. Sales and use taxes in california are among the highest in the united states and are imposed by the state and by local governments. Income tax tables and other tax information is sourced from the california.

California franchise tax board. Limited liability company accessed. California has a franchise tax a corporate income tax and an alternative minimum tax.

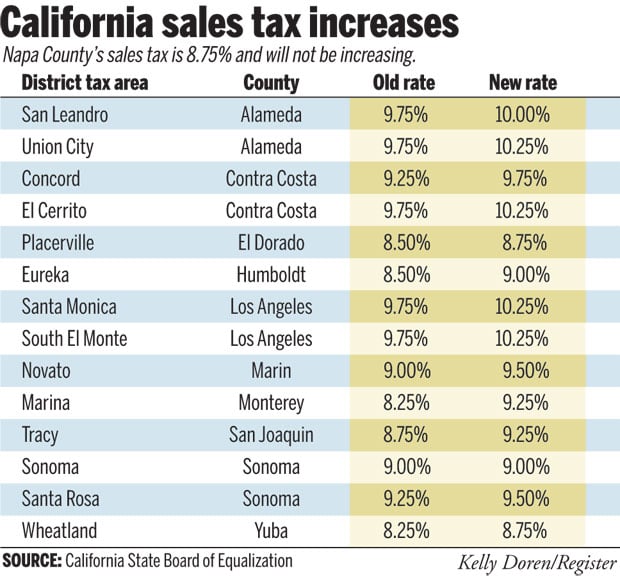

This page has the latest california brackets and tax rates plus a california income tax calculator. From a tax terminology perspective sales taxes are a proportional tax. The federal corporate income tax by contrast has a marginal bracketed corporate income taxcalifornias maximum marginal corporate income tax rate is the 9th highest in the united states ranking directly below maines 8930.

Cities and counties can charge an additional sales tax of up to 25 making the maximum sales tax rate 10 which is among the highest in the country. Business tax rates back to business business tax rates tax rate by entity entity type tax rate corporations other than banks and financials 884 banks and financials 1084 alternative minimum tax amt rate 665 15. California franchise tax board.

Californias 2020 income tax ranges from 1 to 133. Accessed april 1 2020. Your business may be subject to one or more of these taxes depending on both its amount of taxable income and its legal form.

This amount is levied on most domestic and foreign llcs registered in california whether they did business in that tax year or not. Though because of the fact that lower income earners may pay a greater percentage of their earnings to sales taxes than higher income earners a sales tax is also described as a regressive tax. California has a flat corporate income tax rate of 8840 of gross income.

How Much Tax Do Small Businesses Pay A Simple Guide Freshbooks

How Much Tax Do Small Businesses Pay A Simple Guide Freshbooks

State Corporate Income Tax Rates And Brackets For 2019

State Corporate Income Tax Rates And Brackets For 2019

Small Business Tax Rate 2020 Guide For Business Owners

Small Business Tax Rate 2020 Guide For Business Owners

California Individual Liable For Unpaid Business Taxes Avalara

California Individual Liable For Unpaid Business Taxes Avalara

How Does The Corporate Income Tax Work Tax Policy Center

How Does The Corporate Income Tax Work Tax Policy Center

Calif Business Owners Pay Highest Income Tax Rate Orange County

Calif Business Owners Pay Highest Income Tax Rate Orange County

California Payroll Tax Breaking Down The Basics Squar Milner

California Payroll Tax Breaking Down The Basics Squar Milner

Your First Look At 2020 Tax Rates Projected Brackets Standard

Your First Look At 2020 Tax Rates Projected Brackets Standard

What S The Corporate Tax Rate Federal State Rates

What S The Corporate Tax Rate Federal State Rates

Property Tax In The United States Wikipedia

Property Tax In The United States Wikipedia

2020 State Individual Income Tax Rates And Brackets Tax Foundation

2020 State Individual Income Tax Rates And Brackets Tax Foundation