How Do I Get Tax Exempt For My Business

Am i exempt from hawaii general excise tax get. To get these savings on sales taxes you must apply to your state for a sales tax certificate.

Business Tax Business Tax Exempt Number

Business Tax Business Tax Exempt Number

how do i get tax exempt for my business

how do i get tax exempt for my business is important information with HD images sourced from all the best websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how do i get tax exempt for my business content depends on the source site. We hope you do not use it for commercial purposes.

Should i amend my tax returns.

How do i get tax exempt for my business. Exempt organization business income tax return yes form 990 w estimated tax on unrelated business taxable income for tax exempt organizations no form 990 bl information and initial excise tax return for black lung. How to get a business tax exempt number. But not all businesses have to pay taxes.

If you think your business might qualify for tax exempt status you need to apply for recognition of exemption through the irs to get a number and be added to their tax exempt number lookup bank. Have you ever wondered is my business tax exempt there are rules you have to follow for tax exempt status set by the irs. Nonprofit entities are organized under state law to engage in charitable activities.

How to become a tax exempt business. An estimated tax may show until the final screen. Most organizations and nonprofits use irs form 1023.

As a small business owner you probably spend a lot of time and money on taxes. A sales tax certificate may also be called a resellers certificate resellers license or a tax exempt certificate depending on your state. A business that is tax exempt has been recognized by the internal revenue service as soliciting donations and generating revenues for nonprofit purposes.

Should i amend my tax returns. The streamlined tax exemption certificate is valid in 44. If approved you will be eligible to make tax exempt purchases immediately.

These same entities can request an exemption from corporate taxes from the internal revenue service. Fortunately streamlined sales tax sst makes the process easier whether youre selling to tax exempt organizations or you need an exemption for your own business. Exempt organizations form 1023 ez approvals publication 4220 applying for 501c3 status pdf publication 557 tax exempt status for your organization pdf group exemptions pdf faqs applying for tax exemption.

Please note it may take up to 2 business days for your status to be approved or denied. For the purpose of get only until a final determination that the drivers are employees has been made ie all avenues of appeal have been exhausted dotax is treating you as an independent contractor 1099 since the platforms are not paying tax.

Sample Letter Requesting Sales Tax Exemption Certificate Lera Mera

Sample Letter Requesting Sales Tax Exemption Certificate Lera Mera

Is My Business Tax Exempt Qualifications For Business

Is My Business Tax Exempt Qualifications For Business

What Are The Different Types Of Tax Exempt Income

What Are The Different Types Of Tax Exempt Income

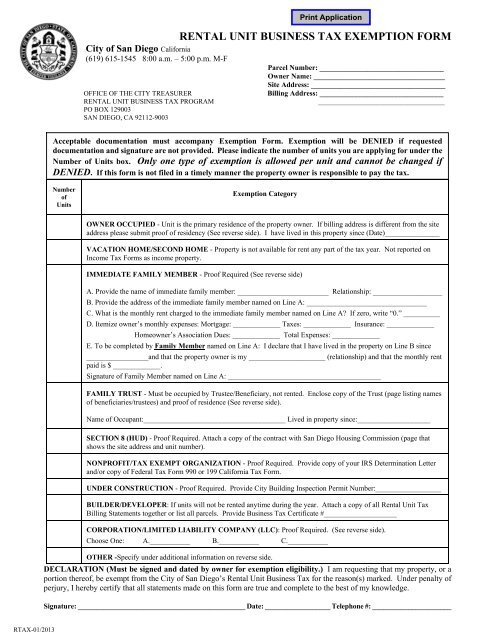

Rental Unit Business Tax Exemption Form City Of San Diego

Rental Unit Business Tax Exemption Form City Of San Diego

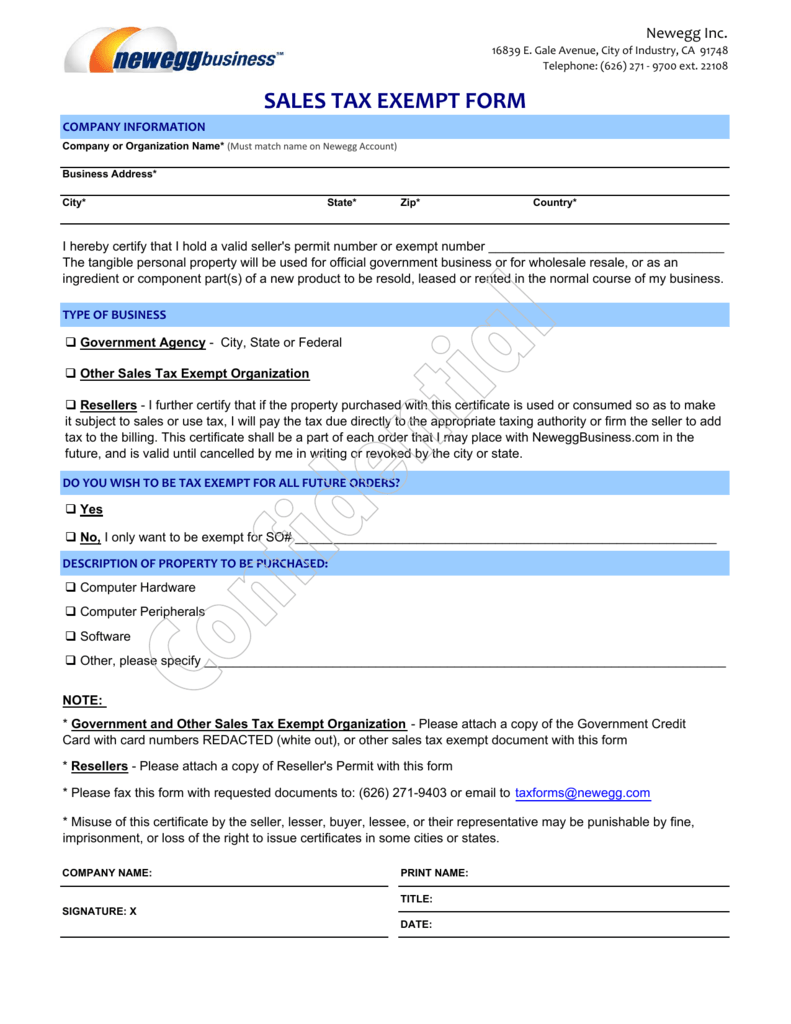

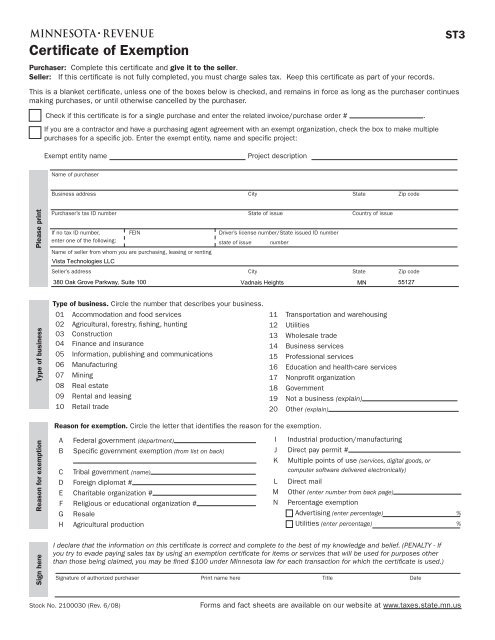

Tax Exempt Form Pdf Vista Technologies

Tax Exempt Form Pdf Vista Technologies

Free Sample Template Of Certificate Of Exemption

Free Sample Template Of Certificate Of Exemption

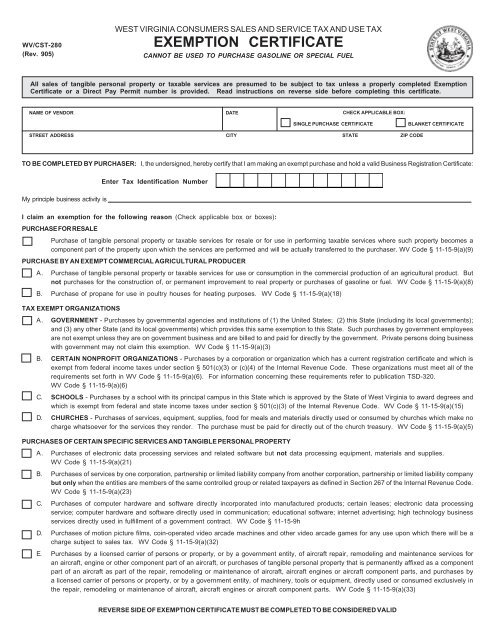

West Virginia Tax Exempt Certificate

West Virginia Tax Exempt Certificate

/GettyImages-989124584-3d388da139694016a7c9da74898fb95e.jpg) What Does It Mean To Be Tax Exempt

What Does It Mean To Be Tax Exempt

Https Forms In Gov Download Aspx Id 2717