Advantages And Disadvantages Of Private Equity Financing

Private equity firms invested 347 billion in 2083 us. Equity financing is the main alternative to debt conscious business owners.

advantages and disadvantages of private equity financing is important information accompanied by photo and HD pictures sourced from all websites in the world. Download this image for free in High-Definition resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark advantages and disadvantages of private equity financing using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

Learn more in the hartford business owners playbook.

Advantages and disadvantages of private equity financing. Equity financing definition exampleadvantages and disadvantages equity financing raising capital during the start up phase of a business or for the development or purchase of a new commercial property can present challenges to an entrepreneur or property developer. Small businesses face the constant challenge of raising affordable capital to fund business operations. Disadvantages of equity financing.

Investors not only share profits they also have a say in how the business is run. However you do lose some control of the business. Of course a companys owners want it to be successful and provide equity investors a good return on their investment but without required payments or interest charges as is the case with debt financing.

The main advantage of equity financing is that there is no obligation to repay the money acquired through it. The primary difference between debt vs equity financing is that debt financing is the process in which the capital is raised by the company by selling the debt instruments to the investors whereas equity financing is a process in which the capital is raised by the company by selling the shares of the company to the public. To understand the pros and cons of equity finance from a company point of view lets discuss the benefits and disadvantages of equity as a source of financing.

Equity financing comes in a wide range of forms including venture capital an initial public offering business loans and private placement. There is no loan to pay off. Equity financing is one of the main funding options for any corporation.

There are plenty of options for businesses looking for financing. Private equity funding is also available to companies in many countries around the world. While this has advantages you need to think carefully about how much control you surrender.

Advantages and disadvantages of equity finance advantages permanent source of finance. Shared ownership in return for investment funds you will have to give up some control of your business. Advantages and disadvantages of equity finance equity finance the process of raising capital through the sale of shares in a business can sometimes be more appropriate than other sources of finance eg bank loans but it can place different demands on you and your business.

Companies in 2012 spread across different industries and in different statesthe biggest recipient of private equity funding was texas followed by california colorado illinois and florida.

Dr Ebi Ofrey Business Advisor Series Financing Options

Dr Ebi Ofrey Business Advisor Series Financing Options

Private Equity And Angel Financing

Private Equity And Angel Financing

Private Equity Investments Ppt Download

Private Equity Investments Ppt Download

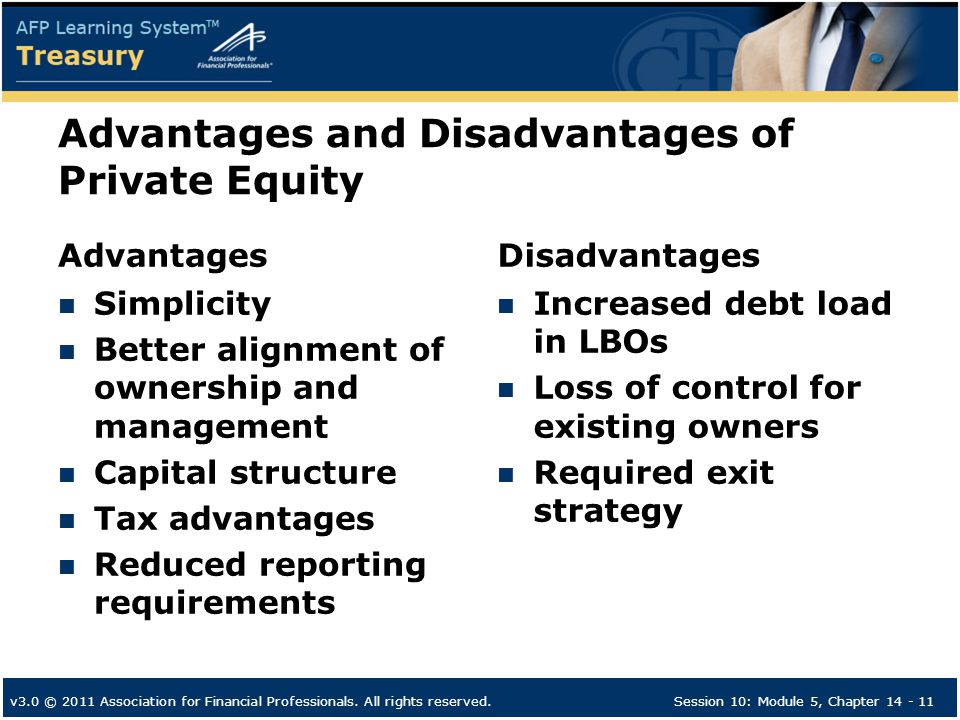

Chapter 14 Capital Structure And Dividend Policy Ppt Download

Chapter 14 Capital Structure And Dividend Policy Ppt Download

Private Equity And Angel Financing

Private Equity And Angel Financing

Public Private Partnership Pros And Cons

Public Private Partnership Pros And Cons

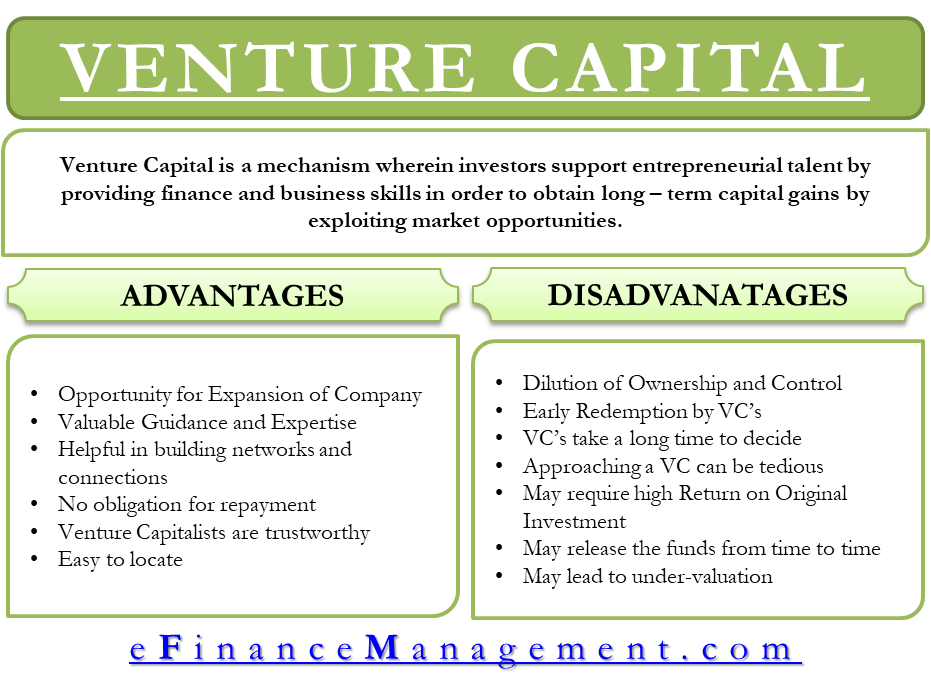

Advantages And Disadvantages Of Venture Capital

Advantages And Disadvantages Of Venture Capital

Benefits And Disadvantages Of Equity Shares Investment

Benefits And Disadvantages Of Equity Shares Investment

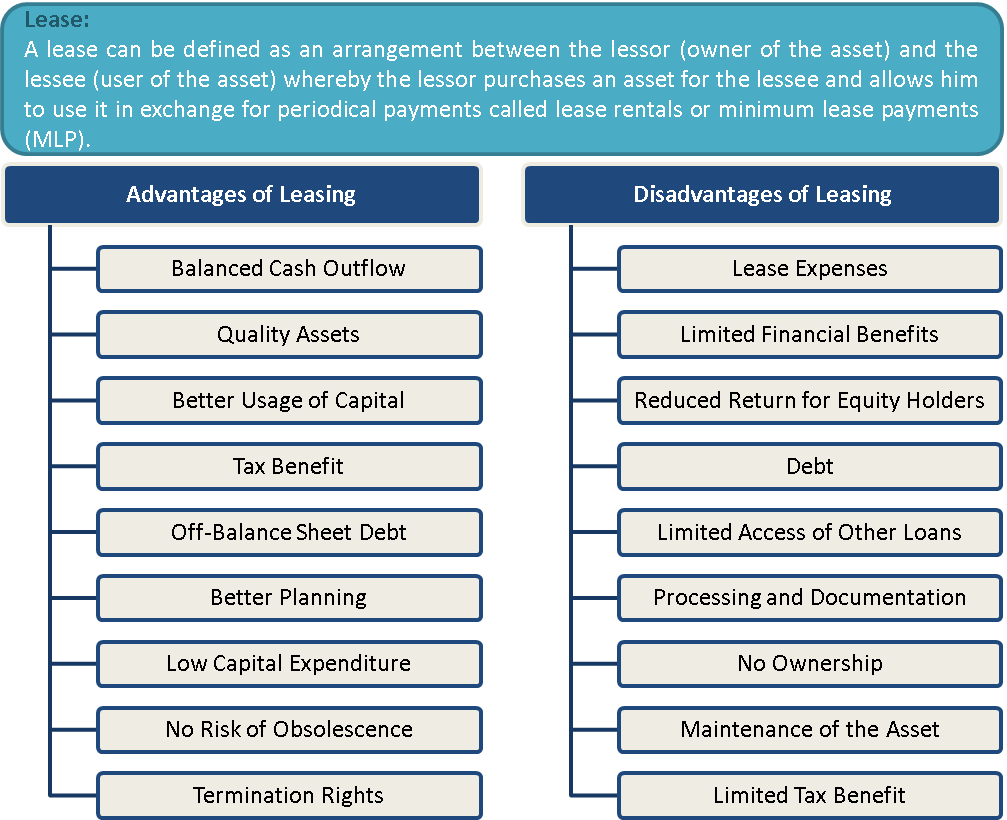

What Is Leasing Advantages And Disadvantages

What Is Leasing Advantages And Disadvantages

Disadvantages Of Equity Finance World Finance Contesuca Ml